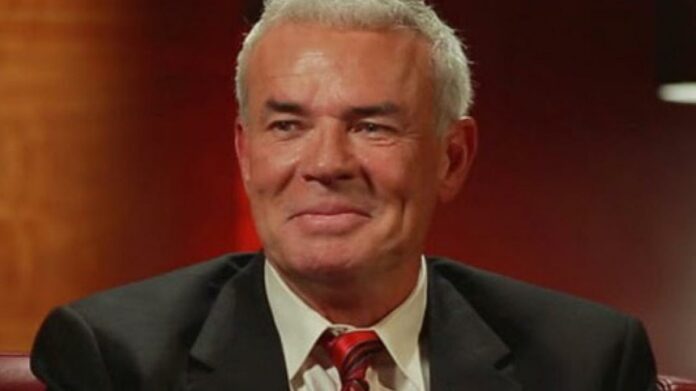

As previously stated, WWE Hall of Famer Eric Bischoff recently released “Grateful,” his autobiography sequel to 2006’s “Controversy Creates Cash.” Grateful, co-produced with “NITRO” author Guy Evans, delves into Bischoff’s post-2006 career, including his WWE return, AEW involvement, TNA experience, and more.

The book is available in paperback, hardcover, and eBook formats. On Amazon, the book is still ranked 31st in the category “Wrestler Biographies.”

The publisher provided the following excerpt from the book, in which Bischoff discusses Bischoff Hervey Entertainment, navigating the ever-changing TV industry, filing for bankruptcy, and other topics:

It took a long time for me to get comfortable with – and even to wrap my head around – the idea of doing personal appearances. I can’t really say why, exactly; I just knew that whenever I would get offers to do appearances, I would always turn them down.

By virtue of the success that Jason and I had experienced with BHE, there was never much time to entertain such events anyway. I was busy; plus, I really didn’t need the money, quite honestly. I felt that my time was at a premium.

There was also another reason why the idea of signing autographs at a convention, or doing a personal appearance of that nature didn’t appeal to me. It was probably a result of my ego, or maybe just good old-fashioned pride – if there’s any difference between the two. It was just an uncomfortable notion for me. I knew that I didn’t look like the Eric Bischoff that was pictured on the 8×10’s that I was signing. That might be hard for some readers to relate to, but at the time, that’s how I felt.

But then, as 2014 rolled around, shit really hit the fan. While Jason and I had enjoyed a lot of success with BHE since its formation in 2003, things in television were really starting to change. We realized that while we had been big enough to be successful – we had created and produced reality television for almost every cable outlet – we had never been big enough to be acquired (or, alternatively, to have the opportunity to work exclusively with a major studio).

That fact mattered as the television industry shifted. It had become much more competitive within the marketplace (and across the entertainment landscape more generally); consequently, cable outlets and networks were now very cautious about trying new shows, new concepts – anything new. What had been, with respect to ‘non-scripted’ or reality television specifically, kind of like a wild, wild, west environment previously – we had literally pitched shows on the back of a bar napkin – now resembled a process that was both more difficult and time consuming.

Moreover, the profit margins were beginning to get crushed. Producing television shows became much less of a profitable venture, and due to the increased competition, there was less and less volume for an independent production company like ours. The pressure seriously started to mount on Jason and I, and eventually, we came to an important realization. Quite simply, times had changed – we had changed – everything had changed, really. We didn’t see ourselves competing at the level that was needed to be financially successful, and therefore, we agreed to dissolve BHE.

In addition to Jason and I going our separate ways, my involvement with TNA had come to an end, too. Now believe me, while there were no tears shed – or a minute of emotion about no longer being a part of TNA – the combination of losing both sources of income meant an abrupt halt in cash flow.

—-

I had been living pretty well over the previous 20 years, making significant amounts of money along the way. Nonetheless, I wasn’t nearly where I would’ve liked to have been when BHE (and, to a lesser extent, TNA) came to an end. Then again, for a long time, everything had been going my way.

For that reason, it was a surprise to many when it came out – quite a long time after the fact, incidentally – that I eventually had to file for Chapter 11 bankruptcy.

It was embarrassing – firstly, being at the stage of my life when most people are looking at their 401ks growing and growing, or maybe their houses have just been paid off, things like that.

But here I was – essentially starting over, at 62 years old.

A lot of things precipitated my filing for bankruptcy, despite having made millions and millions of dollars over my career. One of the biggest factors was that as an entrepreneur, I was always attracted to risk.

It’s easy to see potential in an opportunity, but it’s not so easy to understand how to manage the risk involved in it. Naturally, if I see an opportunity – and I’m convinced in that opportunity – I don’t give a shit about the risk. I don’t even wanna talk about it, other than, ‘Ok, we’ll write down the risk – or risks – on a piece of paper,’ but that’s about it. I was always so laser focused on the opportunity side of the equation.

As an entrepreneur, one of the characteristics that has always worked for me is having no fear. I have no fear of anything – or anyone – other than fearing for my family’s health and safety. But when it comes to anything outside of my family, I just don’t have any fear.

I’m not afraid to fail, as is often the case with people who have been entrepreneurs throughout their lives. I always believed that no challenge was too big, that there was always a solution to whatever problems I – or my business partners – may have encountered. I would look at something that was working and say, ‘Wow – there’s a great opportunity there. What if I do that?’

Loree was always the logical one: Well, how are you going to do that?

My response was always the same: I’ll figure it out.

I didn’t necessarily figure things out all by myself, by the way. I would ‘tag in’ people who possessed more experience than I did in certain areas. Nonetheless, the answers are out there, I always thought.

Inherently, people are often afraid – even more so now, because it’s so easy for others to judge you, with social media and everything else in our culture. But as an entrepreneur, if I operate from a position of fear – if I think, ‘Yeah, what if it doesn’t work…what if I can’t raise the money…what if I can’t figure it out…’ – I’m toast.

At the same time, once I had to file for Chapter 11, I realized that I needed to get a little smarter with respect to managing risk.