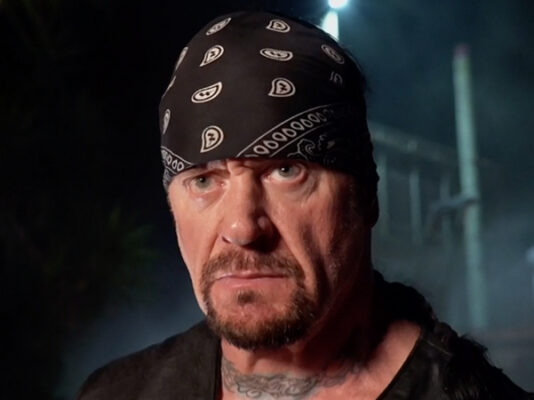

Top WWE executives, including Vince McMahon, are facing a new lawsuit in connection with WWE’s merger with UFC to form the new TKO.

The suit was unsealed last week, revealing that an Ohio pension fund claimed McMahon and other Board members pushed for a “quick sale” that was favorable to Endeavor. It was claimed that McMahon made the deal with Endeavor because of his friendship with the company’s founder, Ari Emanuel.

The Hollywood Reporter and Bloomberg Law broke the story first. Some investors believe the deal was made to keep McMahon as TKO Executive Chairman while also preventing him from being fired over sexual misconduct allegations that surfaced last year.

WWE allegedly turned down two all-cash offers that they perceived to have better terms. The other potential bidders were not named, but they were described as “major institutions with significant access to capital” with “compelling reasons to close an acquisition of WWE.”

“According to the complaint, this included undisclosed companies submitting cash offers at $95-$100 and $90-$97.50 per share,” according to the report. “But because they contemplated cashing out WWE stockholders and barred McMahon from rolling over his shares, which would’ve signaled his “complete ouster” from the wrestling world, the board “never bothered to make” counterproposals, the suit states.”

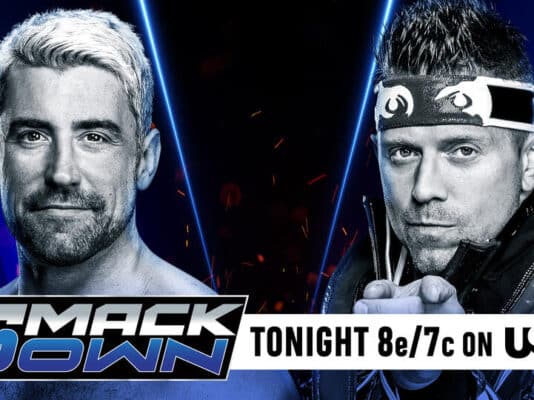

When the merger was completed, the $95.66 per share price was less than that of competing offers. According to the suit, McMahon and the Board “conjured up a sham sales process” to position Endeavor as the front runner, which also named Nick Khan, Paul Levesque, George Barrios, and Michelle Wilson.

Khan, Levesque, and Frank Riddick were singled out for the $25 million in cash bonuses they received as a result of the merger.